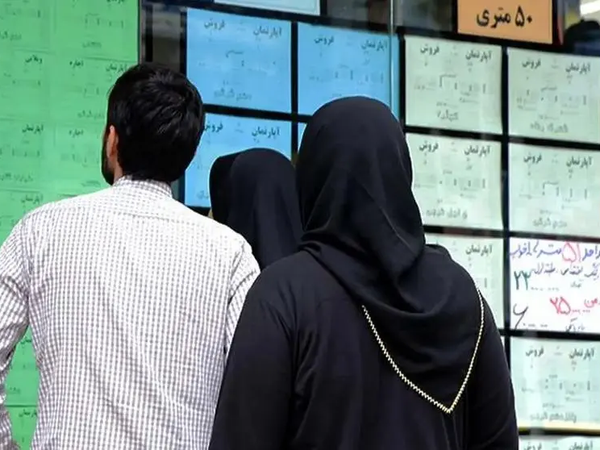

Recent statistics have shown sharp increases in housing rents and other essential costs as inflation soars amid Iran's worst economic crisis since the founding of the Islamic Republic.

Iran’s Statistics Center revealed that rental rates in urban areas rose by approximately 42% in the last 12 months compared to the same period last year. This rate significantly outpaced general inflation by 8.6 percentage points, despite a government-imposed cap of 25% on rent hikes announced in July.

Since July, following the implementation of a cap on rent increases, annual inflation in this sector, as reported by the Statistics Center, has been recorded at 41.4% in August, 41.7% in September, 41.8% in October, and now 41.7% in November.

Throughout these four months, rent inflation has exceeded general inflation. From September to November, rent inflation compared to general inflation has been reported to be higher by 6.6, 7.5, 8.2, and 8.6 percentage points, respectively.

The cost of renting has faced a significant surge since 2020, a combination of housing prices rising and the country's inflation rising since 2019. The government’s strategy of command pricing is not addressing the root causes of inflation, reported the financial newspaper Donya-e-Eqtesad.

Rental price inflation is part of a wider trend of rising costs in Iran, with recent moves by the government signaling potential price increases in gasoline and automobiles. It comes alongside rising energy costs and insufficient incomes.

The government recently authorized controversial measures to burn mazut in power plants to address the energy crisis, exacerbating environmental and public health concerns. Meanwhile, a resolution by the Economic Council mandates higher gas tariffs to curb overconsumption, further burdening households.

Simultaneously, domestic carmakers Iran Khodro and SAIPA announced price increases of up to 30% for their products, citing financial losses and heavy debts. Critics have called the car market one-sided, accusing the government of supporting monopolistic practices by banning imports.

The situation is reminiscent of the 2019 fuel price protests which saw widespread unrest and the deaths of hundreds of protesters. Economists warn that any rise in fuel prices could trigger inflationary shocks across the economy.

Hossein Raghfar, an economist at Al-Zahra University told Jamaran News: “Raising fuel prices without addressing systemic economic issues will harm everyone and increase tensions."

As the Iranian government struggles to manage rising costs and budget deficits, the consequences of inflation are felt acutely by ordinary citizens with one third of Iranians now living below the poverty line and basic goods like food becoming ever harder to afford.